Pre-Salt

Pre-Salt

T&B Petroleum/Press Office MME

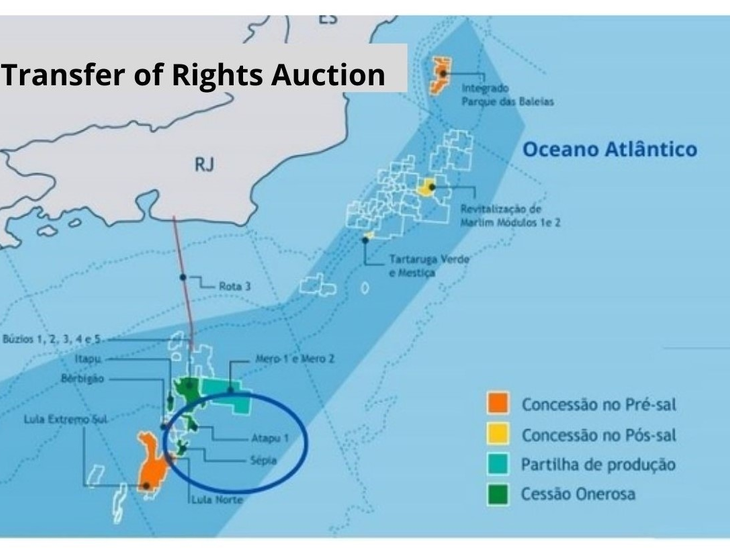

In June, the Ministry of Mines and Energy (MME) published the minutes of the pre-bid and contract for the auction of the Atapu and Sépia pre-salt fields, scheduled to take place in December this year. This, which will be the biggest oil and natural gas event this year, should attract investments of R$ 200 billion by 2050, considering a price trajectory below US$ 50.00/barrel. The auction of surpluses from the transfer of rights, in the Santos Basin, should raise up to R$ 11.1 billion for the Union with signature bonuses alone, of which R$ 7.7 billion will be transferred to states, the Federal District and municipalities.

According to the assistant executive secretary of the MME, Bruno Eustáquio, the schedule foresees a public hearing in late June or early July. After the contributions and consolidation of the evaluations, the set of information will proceed to evaluation by the Federal Court of Accounts (TCU), which has significantly contributed to this second round. “The idea is to publish the final notice in October and hold the event by the third week of December,” explained Eustáquio.

Optimistic with the interests expressed so far, Bruno Eustáquio confirmed the desire expressed by large foreign companies to participate in the auction of surpluses from the transfer of rights granted by Sépia and Atapu. He also mentioned that the MME, together with the Brazilian Export and Investment Promotion Agency (Apex-Brasil), and other government agencies, are working with an intense agenda of interaction with companies and investment funds starting in July .

Bruno Eustáquio highlighted that, “as a result of the improvement for this tender, that is, the availability of the draft co-participation agreement, together with the public notices, we had this week the signing of the co-participation agreement between Petrobras and Pré-Sal Petróleo SA (PPSA), and the Chinese CNODC Brasil and CNOOC Petroleum, still subject to approval by the National Petroleum Agency (ANP)”.

In the 2019 auction of surpluses from the transfer of rights, a record collection of almost R$ 70 billion was registered by the two blocks, Atapu and Búzios, both bought by Petrobras. The Búzios area was left to the consortium formed by the state-owned company, along with the Chinese CNODC Brasil and CNOOC Petroleum. Itapu, was entirely for Petrobras. At the end of the tender, the Minister of Mines and Energy, Bento Albuquerque, considered the auction a success and said that Brazil was on the right path since Brazil “is the place where investments in oil and gas find legal security, predictability, and with governance that attracts investments. This auction is a source of great pride for Brazil”, said the minister at the time.

Signature Bonus

The Atapu field will have a signing bonus of R$4 billion. The Sepia block, for R$7.1 billion. Signature bonus is the amount to be paid to the government by the winning companies in the bidding areas. The percentage of oil to be extracted, the so-called minimum profit-oil rate, which will remain with the Union, was set at 5.89% for the Atapu field and 15.02% for the Sépia field.

Petrobras, according to Bruno Eustáquio, has already had preemptive rights in both areas. “This circumstance gives credibility to the tender, as it signals to other companies the vision of a company that is already present in fields with production, signaled Bruno Eustáquio.

Contact us