Pre-Salt

Pre-Salt

European oil majors given a taste of Brazil may soon be ready for more.

BloombergNorway’s Statoil ASA, Anglo-Dutch company Royal Dutch Shell Plc and France’s Total SA have paid billions since 2013 to gain access to Brazil’s fertile offshore oil riches. They’re now seen as having the best chance to expand when Brazil later this year auctions four more blocks in the prolific play known as the pre-salt along the country’s east coast.

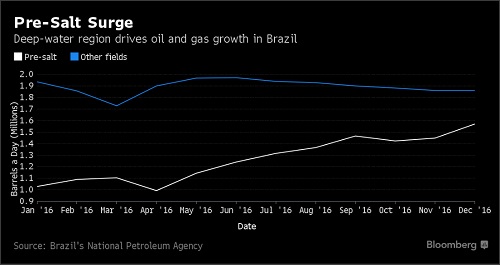

The region already produces about 1.3 million barrels of crude a day. By 2023, that’s set to surpass 2 million barrels a day, eclipsing Norway and a majority of OPEC producers. Such a move offers the Europeans a solid return on their investment and Brazil perhaps its best chance at an economic revival following a major corruption probe involving the state-owned energy company, Petroleo Brasileiro SA.

The Europeans “definitely have a leg-up, there’s no question,” said Cleveland Jones, a geologist at Rio de Janeiro State University, citing the companies’ familiarity with the government and the region’s deep-water geology. “They’ve done what is a very strategically positive thing for them, though it doesn’t close the door to anybody.”

The decision to open Brazil’s most prized energy discovery to outsiders was spurred by the financial and legal struggles at Petrobras following a sprawling corruption scandal. During the commodities boom, the company lost billions investing in unprofitable refineries and subsidizing fuel imports, resulting in the loss of its investment-grade rating.

The pre-salt region was formed when the South American and African continents began separating more than 100 million years ago, gaining its name from a thick salt layer that blankets the deposits. Production of oil and natural gas began in 2010 at the Lula deposit, which has become Brazil’s largest producing field at 711,000 barrels a day.

Production Peak

The National Petroleum Agency, or ANP, expects more than half of Brazil’s output to come from pre-salt wells when production peaks at almost 4.5 million barrels a day in 2025, according to a presentation on its website.

Last year, Statoil forged a $2.5 billion deal with Petrobras for a majority stake in a block that holds the region’s Carcara deposit. The Stavanger-based producer has said it will compete in the next round of bidding for an adjacent area to control the entire deposit.

Shell, meanwhile, is the operator of the Gato do Mato field, one of the first auctioned off by Brazil. That block also stretches beyond the original concession boundaries, and the company has said it too will bid in the upcoming round.

Total’s Stake

In December, Total agreed to buy a controlling stake in the Lapa field in a $2.2 billion deal that also includes a minority stake in the Berbigao field that is set to start pumping in 2018.

While Total’s press office declined to comment on whether the company will join the bidding in September, Chief Executive Officer Patrick Pouyanne extolled the virtues of Brazil’s oil future in a Bloomberg Television interview in New York on Tuesday.

“In the oil and gas business you go where you find oil and gas,” Pouyanne said. “One of Total’s strengths is deep water. We are able to develop deep-water fields; in Africa, and Brazil is the obvious place where we can find these types of huge resources.”

Total has a history of teaming up with national oil companies around the world, and is interested in working with Petrobras as a minority partner as well as operating its own projects in Brazil, Pouyanne said.

The other two areas up for auction, Sapinhoa and Tartaruga Mestica, are operated by Petrobras.

Brazil is also planning to offer an estimated three unlicensed pre-salt areas in November where companies other than Petrobras can bid to control operations after Congress changed legislation last year. This second bidding round is likely to draw the widest interest and bring new operators to Brazil’s oil industry, said Marcio Felix, the Energy Ministry’s oil and gas secretary, in an interview last month.

Future Bidding

The 2017 bidding schedule also includes a round for deep-water fields outside the pre-salt later in the year, and another in May for 10 mature fields for small and mid-sized producers. The government hasn’t announced specific areas for the later round.

Petrobras is also likely to continue selling offshore acreage to slash debt, offering another avenue for oil companies to expand in Brazil, said Horacio Cuenca, an analyst at energy consultants Wood Mackenzie Ltd.

“If international companies come and make the right offer, Petrobras will accept,” Cuenca said. “Especially anything that has development capex ahead of it.’’

Contact us