Petrobras

Petrobras

Petrobras Agency

Petrobras announces its first quarter of 2016 results, derived from interim financial information reviewed by independent auditors, stated in millions of Brazilian Reais, prepared in accordance with International Financial Reporting Standards - IFRS issued by the International Accounting Standards Board - IASB.

Main financial highlights (1Q-2016 x 1Q-2015):

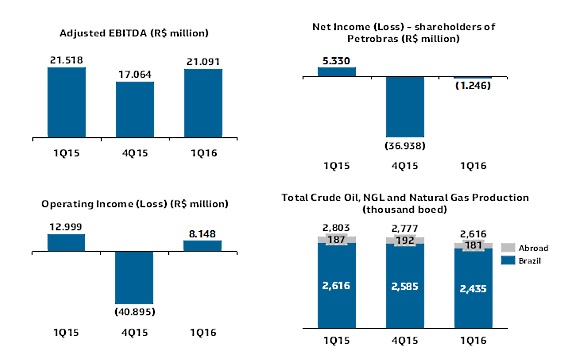

• Net loss attributable to the shareholders of Petrobras of R$ 1,246 million, as a result of:

- Higher interest expenses, inflation indexation charges and foreign exchange losses, totaling R$ 9,579 million in the 1Q-2016;

- A 7% decrease in crude oil and natural gas production (in Brazil and abroad);

- A 8% decrease in domestic oil product sales;

- Higher depreciation expenses; and

- Higher idleness expenses with equipments, mainly related to drilling rigs.

• Adjusted EBITDA of R$ 21,091 million in the 1Q-2016, compared to R$ 21,518 million in the 1Q-2015. The Adjusted EBITDA Margin reached 30% in the 1Q-2016.

• Positive free cash flow of R$ 2,381 million in the 1Q-2016 (compare to the negative free cash flow of R$ 1,253 million in the 1Q-2015), due to higher diesel and gasoline domestic margins, decreased production taxes, import costs and lower capital expenditures and investments.

• The gross indebtedness in Reais was R$ 450,015 million in March 31, 2016, a 9% decrease (R$ 42,834 million) compared to December 31, 2015 (R$ 492,849 million).

• Net debt was US$ 103,821 million as of March 31, 2016, a 3% increase when compared to December 31, 2015.

• The ratio between net debt and the Last Twelve Months (LTM) Adjusted EBITDA decreased from 5.31 as of December 31, 2015 to 5.03 as of March 31, 2016 and the leverage decreased from 60% to 58%.

Main operating highlights (1Q-2016 x 1Q-2015):

• Total crude oil and natural gas production decreased 7%, reaching 2,616 thousand barrels of oil equivalent per day (boed).

• Oil product output in Brazil remained relatively flat, totaling 1,958 thousand barrels per day (bpd) and domestic sales volumes reached 2,056 thousand bpd.

• A 14% increase in crude oil and oil product exports (56 thousand bpd) and a 37% decrease of average Brent price (to US$ 33.89/bbl).

• A 21% decrease in lifting costs excluding production taxes in Brazil (to US$ 10.49/bbl).

Contact us