Petrobras

Petrobras

Petrobras Agency

Petrobras informs the volume of its proved petroleum reserves (oil, condensate and natural gas) estimated at the end of 2017 according to ANP/SPE (Brazilian National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) and SEC (US Securities and Exchange Commission) criteria.

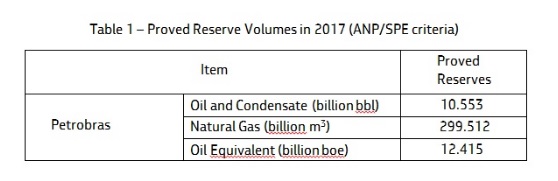

Proved Reserves per ANP/SPE Criteria

According to ANP/SPE criteria, on December 31, 2017, Petrobras’ proved oil, condensate and natural gas reserves reached 12.415 billion barrels of oil equivalent (boe), as shown in Table 1. In 2016, these volumes were 12.514 billion boe.

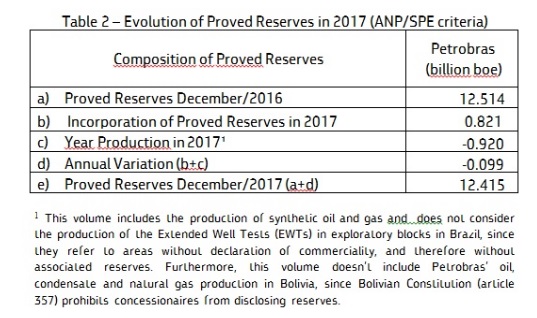

Table 2 details the evolution of proved reserves in 2017, according to ANP/SPE criteria.

Even with a production historical record in 2017, Petrobras was able to replace 89% of the produced volume, mainly due to the drilling of new wells and better than forecasted behavior from reservoirs in the pre-salt of Santos and Campos basins. Regarding onshore fields the highlight was the reduction of operational costs in Solimões basin, Amazonas state.

The ratio between the proved reserves and produced volume is 13.5 years, ( 13.7 years in Brazil). The ratio between developed proved reserves and proved reserves was 49% in 2017.

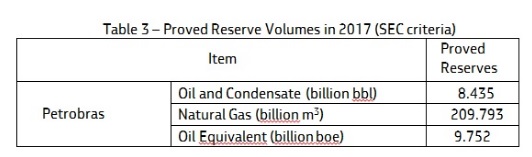

Proved Reserves per SEC Criteria

According to SEC criteria, on December 31, 2017, Petrobras’ proved oil, condensate, and natural gas reserves reached 9.752 billion barrels of oil equivalent (boe), as shown in Table 3. In 2016, those volumes were 9.672 billion boe.

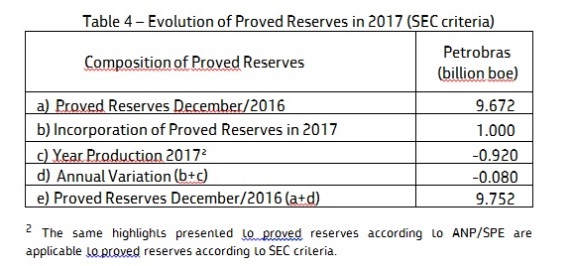

The evolution of proved reserves according to SEC criteria is shown in Table 4:

According to SEC criteria, Petrobras presented a 109% Reserve Replacement Index (RRI). The ratio between the proved reserves and produced volume is 10.6 years (10.7 years in Brazil). The ratio between developed proved reserves and proved reserves was 53% in 2017.

The main difference between ANP/SPE and SEC criteria is the oil price considered in calculating the economic feasibility of reserves.

Petrobras historically submits to certification at least 90% of its proved reserves according to SEC criteria. The current certifying entity is D&M (DeGolyer and MacNaughton).

Contact us