Pre-Salt

Pre-Salt

Petrobras Agency

Petrobras reports on the revision of the Exploration & Production (E&P) segment portfolio in face of the crisis caused by COVID-19. The revision aims to maximize the value of the E&P portfolio, focusing on world-class assets in deep and ultra-deep waters.

The portfolio revision is in line with the price assumptions disclosed in the first quarter results. In addition, the following guidelines were considered: (a) focus on deleveraging, reaching the gross debt target of US$ 60 billion in 2022; (b) focus on resilience, prioritizing projects with Brent price breakeven of not more than US$ 35/barrel and aligned to the company's strategy and; (c) revision of the entire investment and divestment portfolios.

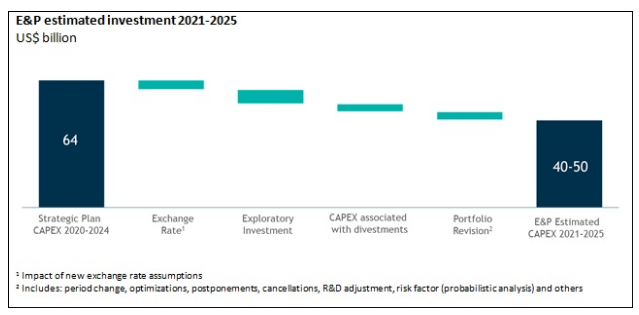

As a result of the portfolio revision, Petrobras estimates a Capex for E&P of approximately US$ 40-50 billion for 2021-2025, as compared to the US$ 64 billion announced in the 2020-2024 Strategic Plan. In addition to the effect of the devaluation of the Real, the following should be highlighted: (a) optimization in exploratory investments, keeping the commitments agreed with the National Agency of Petroleum, Natural Gas and Biofuels, (b) avoided Capex associated with divestments and (c) revision of the investment portfolio, considering optimizations, postponements and cancellations.

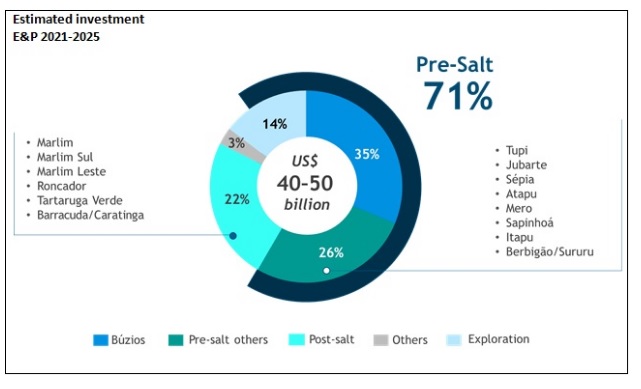

Búzios and the other pre-salt assets will become even more important in the company's portfolio, representing 71% of the total E&P investment for 2021-2025, against 59% in the 2020-2024 Strategic Plan. Investments in these world-class assets, in which we are the natural owners, are in line with our strategic pillars and are resilient to lower oil prices.

As a result of the portfolio revision, Petrobras has decided to include new assets in its divestment portfolio.

The potential impact on the production curve, as well as the start-up schedule for the new platforms, will be announced at Petrobras day 2020, scheduled for the end of November, after the conclusion and approval of the 2021-25 Strategic Plan.

Petrobras reaffirms its strategic pillars and will continue its execution with the objective of creating sustainable value for its shareholders.

Contact us