ANP

ANP

The data comes from ANP's Annual Resources and Reserves Bulletin (BAR), which was released on Wednesday (April 2).

T&B Petroleum/Press Office ANP

On Wednesday (April 2), the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP) released the 2024 edition of the Annual Resources and Reserves Bulletin (BAR). The publication consolidates information on Brazil’s oil and natural gas reserves as declared by exploration and production operators in 2024.

Access the 2024 BAR: https://www.gov.br/anp/pt-br/centrais-de-conteudo/dados-estatisticos/reservas-nacionais-de-petroleo-e-gas-natural

In 2023, there was a 5.92% increase in proven oil reserves (1P) compared to 2022. There was also a 4.36% increase in the combined volume of proven + probable reserves (2P) and a 4.27% increase in proven + probable + possible reserves (3P).

According to declarations from companies holding E&P contracts in Brazil, the following oil reserve volumes were reported:Proven reserves (1P): 16.841 billion barrels; Proven + probable reserves (2P): 24.071 billion barrels; Proven + probable + possible reserves (3P): 29.176 billion barrels.

The oil reserve replacement index (RRI 2024/2023) was 176.63%, representing approximately 2.171 billion barrels of new reserves.

The reserve replacement index (RRI) measures the ratio between the volume of reserves added and the volume produced over a given period.

For natural gas, the following volumes were declared:Proven reserves (1P): 546.022 billion cubic meters; 2P reserves: 672.815 billion m³; 3P reserves: 740.505 billion m³

This represents absolute increases of 5.17%, 4.35%, and 4.26% respectively compared to 2023.

The changes in the volume of Brazil’s oil and gas reserves are the result of several factors, including production during the year, new development projects, declarations of commerciality, and reserve revisions based on technical and economic assessments.

The BAR also provides data on: Reserves by federal unit; the share of proven, probable, and possible reserves per basin;cumulative production by basin and state;recovery factor (total accumulated production divided by in-place resources) per basin.

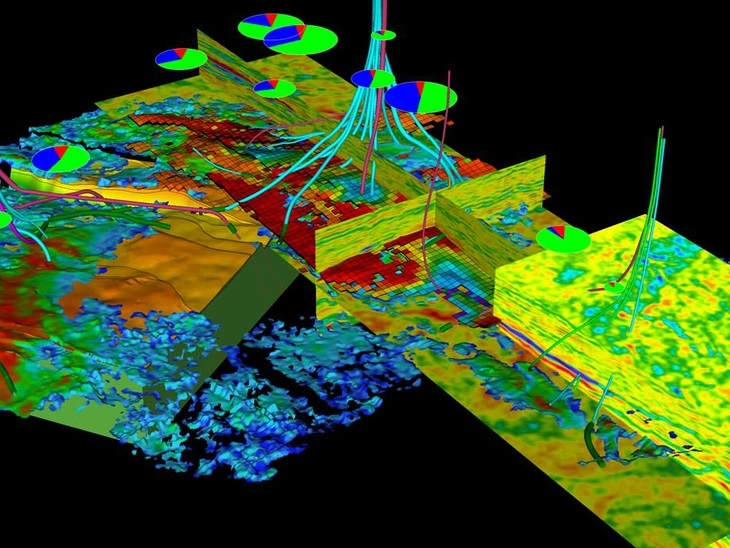

This data is also available in the Dynamic Panel of Hydrocarbon Resources and Reserves, offering interactive features and filter options.

Field operators are required to submit annual information to ANP—by January 31 of each year—including reserve volumes, resources, cumulative production, and in situ volumes for the previous year. The data reported in the BAR must be consistent with each field’s Development Plan and related programs submitted to the agency and must follow the standards set by ANP Resolution No. 47/2014.

Contact us