ANP

ANP

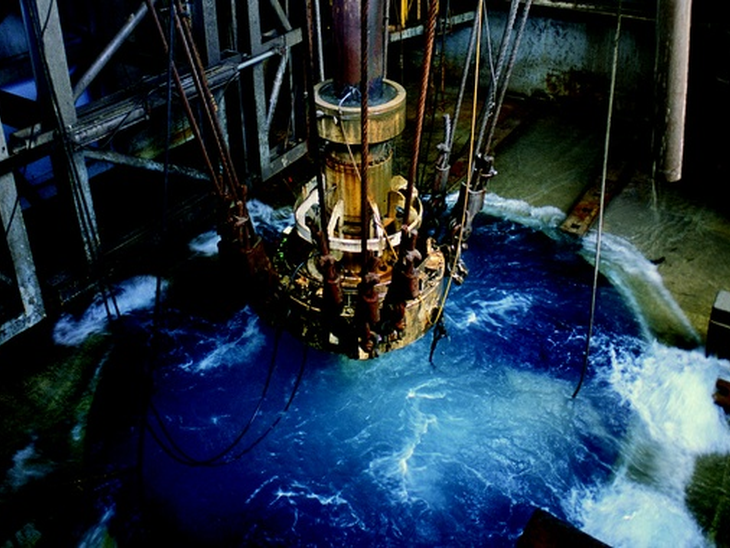

T&B Petroleum/Press Office ANP

The ANP published yesterday (03/31) the twentieth edition of the Annual Bulletin of Resources and Reserves (BAR), with consolidated information on the Brazilian oil and natural gas reserves declared in 2020. In this edition, reserve data per unit of the federation, the proportion of proven, possible and probable reserves by basin, accumulated production by basin and state and the recovered fraction (total accumulated production divided by the volume of resources in place, that is, the total volume of oil in the reservoirs) per basin .

The operating companies of the producing fields must report annually to the ANP, until January 31, the volumes of oil and natural gas related to the previous year. The information contained in the Annual Bulletin of Resources and Reserves must be in accordance with the Development Plan and with the other plans and programs submitted to the ANP. ANP Resolution 47/2014 establishes the guidelines for the preparation of the BAR, through the Technical Regulation for Estimating Resources and Reserves of Oil and Natural Gas (RTR).

In 2020, 11.89 billion barrels of 1P reserves (proved), 17.496 billion barrels of 2P reserves (proven + probable) and 20.273 billion barrels of 3P reserves (proved + probable + possible) were declared, which correspond to to reductions of 6.7%, 3.3% and 24.6%, respectively, in comparison with the year 2019. As for natural gas, 337.238 billion cubic meters of 1P reserves, 408.343 m3 of 2P reserves were declared and 450.247 billion m3 of 3P reserves, which correspond to reductions of 7.9%, 59.6% and 72.1%, respectively, in relation to 2019.

Proven pre-salt oil reserves increased by 3.37% compared to 2019, totaling 8.511 billion barrels.

Proven reserves correspond to the amount of oil or natural gas that the analysis of geoscience and engineering data indicates with reasonable certainty as commercially recoverable, on the reference date of the Annual Bulletin of Resources and Reserves. When probabilistic methods are used, the probability that the amount recovered is equal to or greater than the estimate should be at least 90%. In probable cases, the probability that the amount recovered is equal to or greater than the sum of the proven and probable reserves estimates should be at least 50%. In the case of possible reserves, the probability that the amount recovered is greater than or equal to the sum of the proven, probable and possible reserves estimates should be at least 10%. (Source: ANP Resolution 47, of 3/9/2014).

Em geral, as mudanças ocorridas no volume das reservas de petróleo e gás natural brasileiras são devidas à produção realizada durante o ano, às reservas adicionais oriundas de novos projetos de desenvolvimento, declarações de comercialidade e revisão das reservas dos campos por diferentes fatores técnicos e econômicos. Na comparação entre os volumes de reservas referentes a 2019 e 2020, é importante considerar os impactos da pandemia de Covid-19 no desenvolvimento de projetos do segmento de exploração e produção de petróleo e gás natural e o desconto da produção acumulada recorde no ano de 2020, equivalente a 1,076 bilhão de barris de petróleo e a 45,9 bilhões de metros cúbicos de gás natural.

Thus, the index of replacement of proven oil reserves (IRR 2020/2019) was 25.6%, representing about 275 million barrels in new reserves.

See the Annual Newsletter of Resources and Reservations, click here!

Contact us