Petrobras

Petrobras

Petrobras Agency

Petrobras announces the volume of its proven petroleum reserves (oil, condensate and natural gas) determined at the end of 2016 according to ANP/SPE (Brazilian National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) and SEC (US Securities and Exchange Commission) criteria.

Proven Reserves according to ANP/SPE Criteria

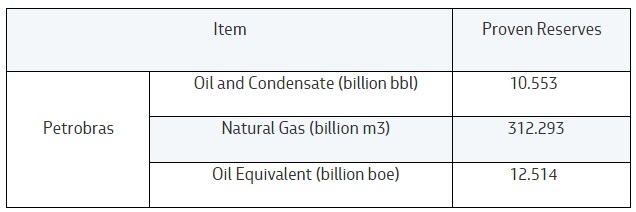

According to ANP/SPE criteria, on December 31, 2016, Petrobras’ proven oil, condensate and natural gas reserves reached 12.514 billion barrels of oil equivalent (boe), as shown in Table 1. In 2015, these volumes were 13.279 billion boe.

Table 1 – Volumes of Proven Reserves in 2016 (ANP/SPE criteria)

Petrobras’ oil, condensate and natural gas volumes in Bolivia have not been recorded since its Constitution prohibits concessionaires from disclosing reserves.

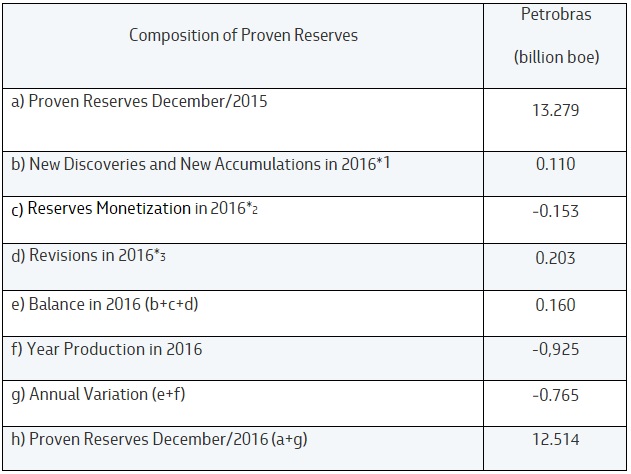

Below, Table 2 details the evolution of proven reserves in 2016, according to ANP/SPE criteria.

Table 2 – Evolution of Proven Reserves in 2016 (ANP/SPE criteria)

¹ Includes Extensions that contain expansions of proven reserves areas through wells drilling after the discovery

² Divestments that represent advanced reserves monetization

³ Revision based on technical and economic criteria (ex: reservoir characteristics)

The main factors impacting reserves were:

• Incorporation of 0.110 billion boe in proven reserves, mainly due to new wells being drilled in the Búzios field (Santos Basin);

• Additions in proven reserves of 0.203 billion boe, resulting from new production development wells being drilled and better performance of reservoirs in post-salt onshore and offshore areas, in Brazil and the USA. In the pre-salt, the additions in proven reserves were a result of a positive response in reservoir performance, recovery mechanisms (water injection) and the operating efficiency of production systems in operation, as well as the growth of drilling activities and tie-back activities, in the Santos and Campos Basins, both in Brazil;

• Divestments that provided early monetization of 0.153 billion boe of Petrobras in Argentina and Venezuela reserves;

• Production of 0.925 billion boe in 2016. This volume includes shale, although does not include the volume extracted from Extended Well Tests (EWT) nor production in Bolivia. EWTs occur in exploratory areas where field commerciality has not yet been declared and, therefore, there is no associated reserve; in the case of Bolivia, the country’s Constitution prohibits concessionaires from recording reserves.

• Petrobras showed a 34% Reserve Replacement Index (RRI), disregarding the effects of divestments carried out in 2016. The ratio between the volume of reserves and production volume is 13.5 years, and 13.9 years in Brazil. The Development Ratio (RD), which is the ratio between developed proven reserves and proven reserves, which was 50% in 2016.

Proven Reserves according to SEC Criteria

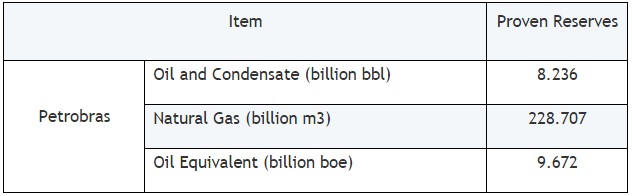

According to SEC criteria, on December 31, 2016, Petrobras’ proven oil, condensate, and natural gas reserves reached 9.672 billion barrels of oil equivalent (boe), as shown in Table 3. In 2015, those volumes were 10.516 billion boe.

Table 3 – Proven Reserve Volumes in 2016 (SEC criteria)

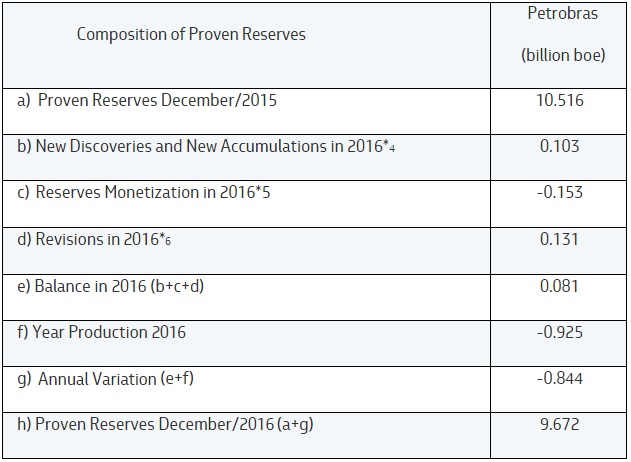

The evolution of proven reserves according to SEC criteria is shown in Table 4 below:

Table 4 – Evolution of Proven Reserves in 2016 (SEC criteria)

4 Includes Extensions that contain expansions of proven reserves areas through wells drilling after the discovery

5 Divestments that represent advanced reserves monetization

6 Revision based on technical and economic criteria (ex: reservoir characteristics)

The same highlights offered above to prove reserves according to ANP/SPE are applicable to prove reserves according to SEC criteria.

The main difference between the ANP/SPE criteria and those by the SEC is the oil price considered in calculating the economic feasibility of reserves.

According to SEC criteria, Petrobras showed a 25% Reserve Replacement Index (RRI), disregarding the effects of divestments carried out in 2016. The ratio between the volume of reserves and production volume is 10.5 years, and 10.7 years in Brazil. The Development Ratio (RD) was 54% in 2016.

Note that Petrobras historically certifies 95% of its proven reserves according to SEC criteria. Currently the certifying company is D&M (DeGolyer and MacNaughton).

Contact us