Proposed Project to Expand Gulf of Mexico Port Capacity

Rigzone

12/08/2016 15:09

A new deepwater port project planned for Louisiana aims to complement existing Gulf Coast infrastructure to service the oil and gas industry.

Located in western Louisiana on the Calcasieu Ship Channel just south of Lakes Charles, the Port Cameron project will allow for faster deployment of supply vessels, support and emergency services for exploration and production (E&P) activities in the U.S. Gulf of Mexico, Jack Belcher, executive vice president of HBW Resources LLC, told Rigzone.

HBW is working with Port Cameron LLC to identify and secure customers for the new port. These customers include inventory management, rig support, transportation management and bonded warehouse and crew support. HBW is also seeking out vendors that support oil and gas operators and drillers, such as providers of cranes, lift trucks and dock side equipment, vessel companies, dockside vessel support, stevedores and air transportation support for rig crews.

Port Cameron presents an opportunity for a brand new, modern port to be added to the Gulf Coast. Even with the oil price downturn, oil and gas activity in the Gulf of Mexico is expected to increase going forward, Belcher stated.

The Gulf of Mexico, the “gift that keeps on giving”, has come back many times, Belcher commented.

“We know how the markets change, and we think this is an area there will be strong potential,” Belcher added.

Belcher said HBW would focus on upstream offshore in its partnership with Port Cameron to identify and secure customers. HBW also is in talks with potential liquefied natural gas (LNG) and downstream customers for investment in Port Cameron. While the port’s primary focus is on oil and gas customers, the port’s potential customer base is not limited to the oil and gas industry, Belcher told Rigzone.

The privately-funded, $1.5 billion port complex, located on the Calcasieu Ship Channel, will encompass 500 acres, with an additional 750 acres available for expansion in the future, HBW Resources said in a July 25 press statement. The port will have over 21,000 linear feet of bulkhead lots on dredged slips of 500 and 700-foot widths, and dredged depths of 33 feet.

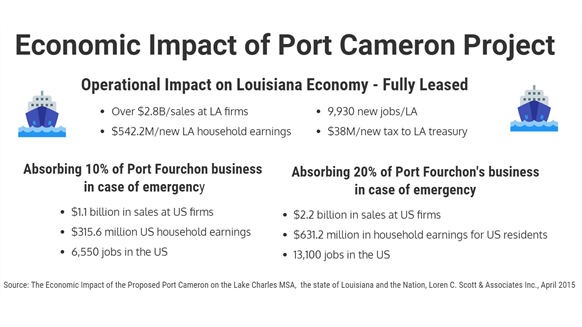

According to a 2015 report by Loren C. Scott & Associates Inc., Port Cameron would not only impact the local economy in Lake Charles and the overall Louisiana economy, but the U.S. economy in terms of its ability to absorb some activities from Port Fourchon if that port’s operations were shut down due to a hurricane or even a terrorist activity. For example, absorbing 10 percent of Port Fourchon’s business would save the national economy approximately $1.12 billion in sales at firms in the country, $315.6 million in household earnings for U.S. residents and 6,550 jobs in the United States, according to the report.

However, Port Fourchon Executive Director Chett Chiasson questions whether the Gulf of Mexico needs another port to service the oil and gas industry. Chiasson told Rigzone that Port Fourchon was able to handle all oil and gas-related activity prior to the oil price downturn, and can certainly handle everything now and in the future.

Chiasson said he believes that Port Fourchon’s landside facilities are the most efficient and effective service for the oil and gas industry anywhere. He also noted that the longest Port Fourchon operations have been down is for four days, and that was following Hurricane Katrina in 2005. Port Fourchon has been building an elevated highway in an 8-mile section of road at a low elevation, but otherwise, the facility’s infrastructure is resilient.

“They have tried to highlight what they see as Port Fourchon’s vulnerability” is promoting Port Cameron, “but we all have the same vulnerability” in terms of threats from hurricanes, Chiasson noted.

Ted Falgout, port director of operations for Port Cameron, told Rigzone that Port Cameron will complement the capabilities of Port Fourchon. He noted that companies who have invested in Port Fourchon may invest in satellite facilities at Port Cameron, but will not abandon Port Fourchon to do so.

Falgout, who previously served as the port director of Port Fourchon for 31 years, said Port Cameron’s position in far western Louisiana is well-positioned to serve oil and gas operations in the Western Gulf, while Port Fourchon is situated to serve the central and eastern Gulf. Port Cameron’s deeper water depth of 42 feet, versus Port Fourchon’s 24-foot water depth, makes the Port Cameron site suitable for LNG vessel activity.

“There is a considerable amount of equipment out there that cannot operate at the depths of Port Fourchon and can at Port Cameron,” Falgout explained.

Right now, all oil and gas companies in the Gulf of Mexico have their eggs in one basket, said Falgout.

“There’s no redundancies and duplications of facilities to the extent necessary to accommodate the huge amount of business Port Fourchon does in case of a disaster or hurricane.”

“There will be port redundancy in the Gulf of Mexico somewhere, perhaps Texas or Mississippi,” said Falgout. “I would rather see that redundancy in Louisiana.”

Panama Canal Expansion Opens Possibility of Additional Port Traffic

Declining oil prices and the resultant slowdown in E&P activity has undeniably impacted port activity throughput along the Gulf of Mexico, Prasad Kulkami, senior manager for business research and advisory services at global research firm Aranca, told Rigzone.

However, with the recent inauguration of the new Panama Canal locks, ports in the Gulf are expected to witness more calls from post-Panamax vessels and consequently a surge in cargo volumes. Panama Canal officials said they already had over 170 reservations for transits through the canal this year, mostly for New Panamax cargo carriers that were unable to fit through the old canal, Bloomberg reported Wednesday.

“Asian carriers will definitely find it more economical to operate through Gulf-based ports rather than go up the East Coast. The gains could potentially be in the range of 4.5-6 million TEUs [twenty-foot equivalent unit] of cargo until 2028 which is roughly a 15 percent growth for ports in the Gulf,” Kulkami explained to Rigzone.

“However, the real impact will only be visible post 2017 once carriers adjust their schedules for the region. These developments definitely augur well for port operators in the region,” Kulkami concluded.