Brazil

Brazil

T&B Petroleum/Press Office ANP

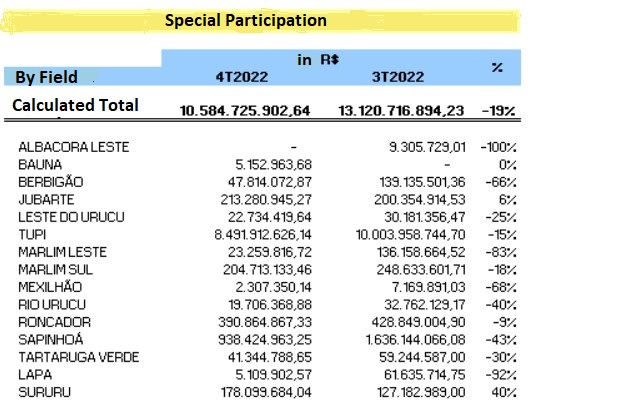

In the 4th quarter of 2022, the collection of special participation (PE) in Brazil was R$ 10.5 billion. The data were disclosed by the ANP and can be checked here.

The PE collected in the 4th quarter fell 19% compared to the 3rd quarter of 2022. The reduction was due to the decline in the reference prices of oil and natural gas, adopted for calculating the PE, which were impacted by the reduction in the international market price Brent, 12%, and Henry Hub, 30%.

Brent is a classification of crude oil. It is a lighter oil, traded on the London Stock Exchange and produced offshore in northern Europe and Asia. The Henry Hub is a trading point for natural gas in North America, a connecting pipeline that transports gas along the entire Gulf Coast of the United States.

The special participation is an extraordinary financial compensation owed by oil or natural gas exploration and production concessionaires for fields with a large production volume, calculated quarterly based on the net revenue from the production of each field, considering the deductions provided for in the applicable legislation.

See below the PE collection values, in each field, in the 3rd and 4th quarters of 2022:

See also the variation in Brent and Henry Hub values:

Contact us