Results

Results

The company's payments represent more than 6% of the total federal revenue.

T&B Petroleum/Petrobras Agency

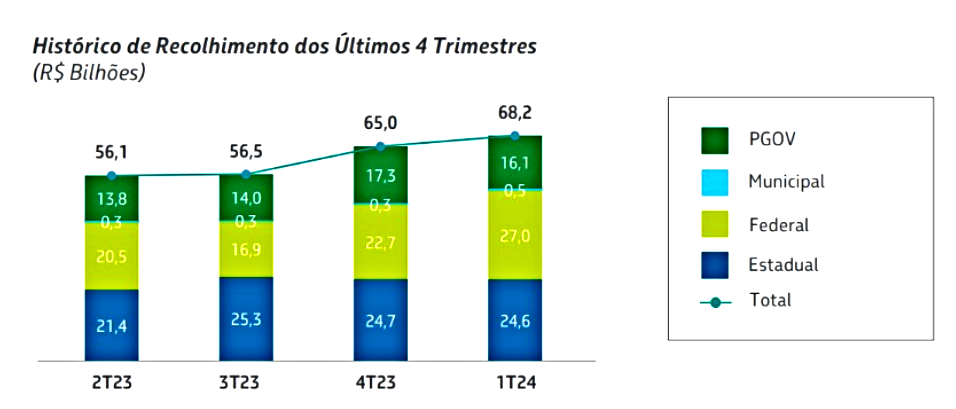

Petrobras paid R$ 68.2 billion in taxes to the federal, state, and municipal governments in the first quarter of 2024, a 9% increase compared to the same period last year. This amount is also 5% higher than the result for the fourth quarter of 2023. The total includes company-specific taxes resulting from Petrobras's operations, government participations (PGOV), and taxes withheld from third parties, as the company is legally responsible for collecting taxes throughout the production chain as a tax substitute.

These figures attest to Petrobras's importance to the Brazilian economy, accounting for about 6.6% of the entire federal revenue. In just the first three months of 2024, the company allocated R$ 43.1 billion to the Union, of which R$ 16.1 billion were solely for government participations. Of the total collected, a portion is transferred to states and municipalities in accordance with current legislation.

Another highlight of the first quarter is the state collections. The company recorded a 31% increase compared to the same period in 2023, totaling R$ 24.6 billion. This amount represents approximately 13% of the total collected by the states during the period. This growth is mainly explained by the increase in the ICMS rates applied to the sale of petroleum-derived fuels.

Contact us