Petrobras

Petrobras

Petrobras Agency

Petrobras announces that holders of U.S.$4,037,681,000 aggregate principal amount of 5.093% Global Notes due 2030 (the “Old Notes”), issued by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”), tendered their Old Notes prior to 5:00 p.m., New York City time, on September 15, 2020 (the “Expiration Date”), pursuant to PGF’s previously announced offer to exchange (the “Exchange Offer”).

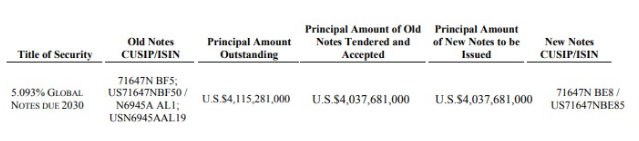

The following table summarizes the final results of the Exchange Offer, the aggregate principal amount of Old Notes that PGF has accepted to exchange and the aggregate principal amount of new 5.093% Global Notes due 2030 (the “New Notes”) registered under the Securities Act of 1933, as amended to be issued:

Old Notes that have been validly tendered prior to the Expiration Date cannot be withdrawn, except as may be required by applicable law. The settlement date on which PGF will exchange the Old Notes accepted in the Exchange Offer for New Notes is expected to be September 17, 2020.

The terms of the New Notes are substantially identical to the Old Notes, except for terms with respect to additional interest payments, registration rights and legends reflecting transfer restrictions. The New Notes are unconditionally and irrevocably guaranteed by Petrobras. Holders of Old Notes accepted for exchange will receive interest on the corresponding New Notes and not on such Old Notes. Any Old Notes not tendered or accepted for exchange will remain outstanding.

The Bank of New York Mellon acted as the exchange agent for the Exchange Offer. Questions or requests for assistance related to the Exchange Offer may be directed to The Bank of New York Mellon at +1 (212) 815-4259.

You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Exchange Offer.

This announcement is for informational purposes only. This announcement is not an offer to exchange any Old Notes.

The Exchange Offer was not made to holders of Old Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction.

Contact us